University of Pennsylvania Press

University of Pennsylvania Press

A Brief History of Doom: Two Hundred Years of Financial Crises

Key Metrics

- Richard Vague

- University of Pennsylvania Press

- Hardcover

- 9780812251777

- 9.1 X 6.3 X 1 inches

- 1.2 pounds

- Business & Economics > Economic History

- English

Secure Transaction

Secure TransactionBook Description

Financial crises happen time and again in post-industrial economies--and they are extraordinarily damaging. Building on insights gleaned from many years of work in the banking industry and drawing on a vast trove of data, Richard Vague argues that such crises follow a pattern that makes them both predictable and avoidable.

A Brief History of Doom examines a series of major crises over the past 200 years in the United States, Great Britain, Germany, France, Japan, and China--including the Great Depression and the economic meltdown of 2008. Vague demonstrates that the over-accumulation of private debt does a better job than any other variable of explaining and predicting financial crises. In a series of clear and gripping chapters, he shows that in each case the rapid growth of loans produced widespread overcapacity, which then led to the spread of bad loans and bank failures. This cycle, according to Vague, is the essence of financial crises and the script they invariably follow.

The story of financial crisis is fundamentally the story of private debt and runaway lending. Convinced that we have it within our power to break the cycle, Vague provides the tools to enable politicians, bankers, and private citizens to recognize and respond to the danger signs before it begins again.

Author Bio

Richard Vague is Secretary of Banking and Securities for the Commonwealth of Pennsylvania. He is the author of A Brief History of Doom, a chronicle of major world financial crises, The Next Economic Disaster, a book with a new approach for predicting and preventing financial crises, and the Illustrated Business History of the United States.

Vague was co-founder, Chairman and CEO of Energy Plus, an electricity and natural gas supply company operating in states throughout the U.S. that was sold to NRG Energy in 2011, and also co-founder and CEO of two banks – First USA, a consumer-oriented bank which grew to be the largest Visa issuer in the industry and which was sold to Bank One in 1997, and Juniper, a bank that was the fastest growing credit card issuer in its era, which was sold to Barclays PLC in 2004.

Richard currently serves on the University of Pennsylvania Board of Trustees and the Penn Medicine Board of Trustees, and on a number of business boards. He is chair of FringeArts Philadelphia, chair of the University of Pennsylvania Press, and chair of the Innovation Advisory Board of the Abramson Cancer Center. He also serves on the Governing Board of the Institute for New Economic Thinking and the board of the Fund for the School District of Philadelphia. Vague is the founder of the economic data service Tychos (tychosgroup.org), which specializes in analyzing private debt trends and also the email newsletter service Delanceyplace.com, which focuses on non-fiction literature.

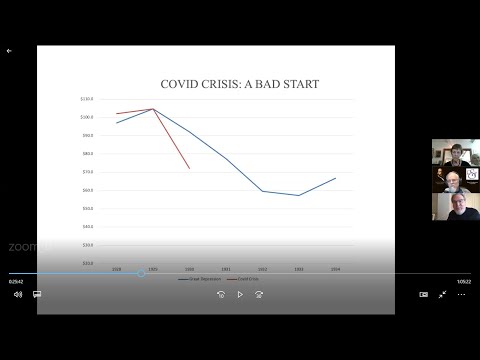

Source: Gabriel Investments

Videos

Community reviews

Write a ReviewNo Community reviews