Oxford University Press, USA

Oxford University Press, USA

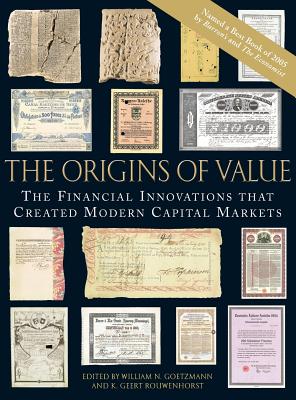

The Origins of Value: The Financial Innovations That Created Modern Capital Markets

Key Metrics

- William N Goetzmann

- Oxford University Press, USA

- Hardcover

- 9780195175714

- 11.1 X 8.7 X 1.1 inches

- 3.2 pounds

- Business & Economics > Finance - General

- English

Secure Transaction

Secure TransactionBook Description

Written by a distinguished group of experts--including Robert Shiller, Niall Ferguson, Valerie Hansen, and many others--and wonderfully illustrated with over one hundred color photographs of landmark financial documents (including the first paper money), The Origins of Value traces the evolution of finance through 4,000 years of history. Readers see how and why many of our most important financial tools and institutions--loans, interest rates, stocks, bonds, mutual funds, the corporation, and the New York Stock Exchange, to name a few--came into being. We see, for instance, how ancient Rome developed an early form of equity finance that resembles the modern corporation and read about the first modern corporation--the Dutch East India Company--and its innovative means of financing the exploration and expansion of European business ventures around the globe. We also meet remarkable financial innovators, such as the 13th century Italian Fibonacci of Pisa, whose mathematics of money became the foundation for later developments in the technology of Western European finance (and may explain why the West surpassed the East in financial sophistication). And we even discover a still-surviving perpetuity dating from the Dutch Age of Reason--an instrument that has been paying interest since the mid-17th century.

Placing our current age of financial revolution in fascinating historical perspective, The Origins of Value tells a remarkable story of invention, illuminating many key episodes in the course of financial history.

Author Bio

William N. Goetzmann is the Edwin J. Beinecke Professor of Finance and Management Studies and Faculty Director of the International Center for Finance at the Yale School of Management. He is an expert on a diverse range of investments. His past work includes studies of stock market predictability, hedge funds and survival biases in performance measurement. His current research focuses on alternative investing, factor investing, behavioral finance and the art market.

Professor Goetzmann has written and co-authored a number of books, including Modern Portfolio Theory and Investment Analysis (Wiley, 2014), The Origins of Value: The Financial Innovations that Created Modern Capital Markets (Oxford, 2005), The Great Mirror of Folly: Finance, Culture and the Crash of 1720 (Yale, 2013) and most recently, Money Changes Everything: How Finance Made Civilization Possible (Princeton, 2016). He teaches portfolio management, alternative investments, real estate and financial history at the Yale School of Management.

Research Interests

- Behavioral Finance

- Financial Crises

- Financial Markets

- Hedge Funds

- Mutual Funds

- Private Equity

- Real Estate/Housing Markets

Source: Yale University

Videos

No Videos

Community reviews

Write a ReviewNo Community reviews