HarperCollins

HarperCollins

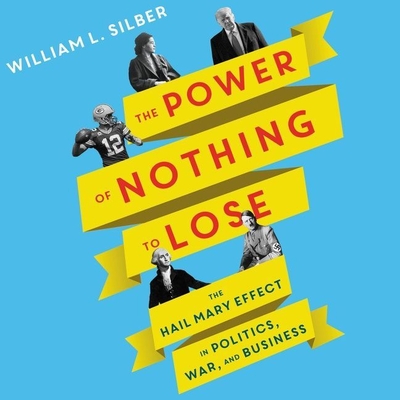

The Power of Nothing to Lose: The Hail Mary Effect in Politics, War, and Business

Key Metrics

- William L Silber

- HarperCollins

- Audio

- 9781665101394

- -

- -

- Business & Economics > Economic History

- English

Secure Transaction

Secure TransactionBook Description

Following books by Malcolm Gladwell and Dan Ariely, noted economics professor William L. Silber explores the Hail Mary effect, from its origins in sports to its applications to history, nature, politics, and business. A quarterback like Green Bay's Aaron Rodgers gambles with a Hail Mary pass at the end of a football game when he has nothing to lose -- the risky throw might turn defeat into victory, or end in a meaningless interception. Rodgers may not realize it, but he has much in common with figures such as George Washington, Rosa Parks, Woodrow Wilson, and Adolph Hitler, all of whom changed the modern world with their risk-loving decisions.

In The Power of Nothing to Lose, award-winning economist William Silber explores the phenomenon in politics, war, and business, where situations with a big upside and limited downside trigger gambling behavior like with a Hail Mary. Silber describes in colorful detail how the American Revolution turned on such a gamble. The famous scene of Washington crossing the Delaware on Christmas night to attack the enemy may not look like a Hail Mary, but it was. Washington said days before his risky decision, If this fails I think the game will be pretty well up. Rosa Parks remained seated in the white section of an Alabama bus, defying local segregation laws, an act that sparked the modern civil rights movement in America. It was a life-threatening decision for her, but she said, I was not frightened. I just made up my mind that as long as we accepted that kind of treatment it would continue, so I had nothing to lose.

The risky exploits of George Washington and Rosa Parks made the world a better place, but demagogues have inflicted great damage with Hail Marys. Towards the end of World War II, Adolph Hitler ordered a desperate counterattack, the Battle of the Bulge, to stem the Allied advance into Germany. He said, The outcome of the battle would spell either life or death for the German nation. Hitler failed to change the war's outcome, but his desperate gamble inflicted great collateral damage, including the worst wartime atrocity on American troops in Europe.

Silber shares these illuminating insights on these figures and more, from Woodrow Wilson to Donald Trump, asylum seekers to terrorists and rogue traders. Collectively they illustrate that downside protection fosters risky undertakings, that it changes the world in ways we least expect.

Author Bio

William L. Silber is the Marcus Nadler Professor of Finance and Economics at the Stern School of Business, New York University. He is also a member of the New York Mercantile Exchange where he has traded options and futures contracts.

In the past he managed an investment portfolio for Odyssey Partners, and has also been a Senior Vice President, Trading Strategy, at Lehman Brothers, a Senior Economist with the President's Council of Economic Advisors, a member of the Economic Advisory Panel of the Federal Reserve Bank of New York, and a member of the investment committee of the SSRC endowment fund. He holds an M.A. (1965) and Ph.D. (1966) from Princeton University and is a graduate of Yeshiva College (1963).

He has consulted for various government agencies, including the Federal Reserve Board, the U.S. Senate Committee on the Budget, the House Committee on Banking and Financial Services, and the President's Commission on Financial Structure and Regulation. He has testified in Congress and has been an expert witness in a number of court cases. In 1980 he received the Excellence in Teaching Award at NYU's Stern School of Business and was voted Professor of the Year by MBA students in 1990, 1997, and 2018. In 1999 he was awarded NYU's Distinguished Teaching Medal.

His newest book, The Story of Silver: How the White Metal Shaped America and the Modern World, (Princeton University Press, 2019) chronicles silver's transformation from soft money during the nineteenth century to hard asset today, and tells how manipulations of the white metal by American president Franklin D. Roosevelt during the 1930s and by the richest man in the world, Texas oil baron Nelson Bunker Hunt, during the 1970s altered the course of history.

An earlier book, VOLCKER: The Triumph of Persistence, Bloomsbury (2012), a biography of former Federal Reserve Chairman Paul A. Volcker, was named the China Business News (CBN) 2013 Financial Book of the Year, was a finalist in the Goldman Sachs / Financial Times 2012 Business Book of the Year Award and has been the subject of in-depth reviews in the press.

In the past he has published over fifty articles in professional journals, has been an Associate Editor of the Journal of Finance and of the Review of Economics and Statistics and has published the following books and monographs: When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy, Princeton University Press (2007); Selected Essays in Finance (editor), Blackwell Publishers (2002); Principles of Money, Banking and Financial Markets (co-author), Addison Wesley (1974, 1977, 1980, 1983, 1986, 1989, 1991, 1994, 1997, 2000, 2004, 2009); Financial Options: From Theory to Practice (co-editor), Dow Jones-Irwin (1990); Money (co-author), Basic Books (1970, 1973, 1977, 1981, 1984); Municipal Revenue Bond Costs and Bank Underwriting, Monograph Series, New York University(1979); Commercial Bank Liability Management, Reserve City Bankers (1978); Financial Innovation (editor), D.C. Heath & Co. (1975); Portfolio Behavior of Financial Institutions, Holt, Rinehart & Winston (1970).

Source: NYU Stern School of Business

Videos

No Videos

Community reviews

Write a ReviewNo Community reviews