Princeton University Press

Princeton University Press

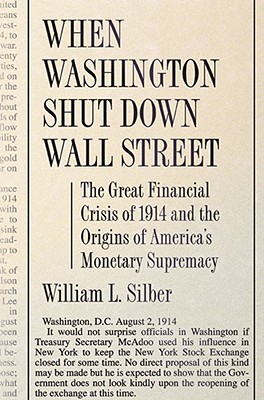

When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy

Key Metrics

- William L Silber

- Princeton University Press

- Paperback

- 9780691138763

- 8.64 X 5.98 X 0.65 inches

- 0.72 pounds

- Business & Economics > Finance - General

- English

Secure Transaction

Secure TransactionBook Description

When Washington Shut Down Wall Street unfolds like a mystery story. It traces Treasury Secretary William Gibbs McAdoo's triumph over a monetary crisis at the outbreak of World War I that threatened the United States with financial disaster. The biggest gold outflow in a generation imperiled America's ability to repay its debts abroad. Fear that the United States would abandon the gold standard sent the dollar plummeting on world markets. Without a central bank in the summer of 1914, the United States resembled a headless financial giant.

William McAdoo stepped in with courageous action, we read in Silber's gripping account. He shut the New York Stock Exchange for more than four months to prevent Europeans from selling their American securities and demanding gold in return. He smothered the country with emergency currency to prevent a replay of the bank runs that swept America in 1907. And he launched the United States as a world monetary power by honoring America's commitment to the gold standard. His actions provide a blueprint for crisis control that merits attention today. McAdoo's recipe emphasizes an exit strategy that allows policymakers to throttle a crisis while minimizing collateral damage.

When Washington Shut Down Wall Street recreates the drama of America's battle for financial credibility. McAdoo's accomplishments place him alongside Paul Volcker and Alan Greenspan as great American financial leaders. McAdoo, in fact, nursed the Federal Reserve into existence as the 1914 crisis waned and served as the first chairman of the Federal Reserve Board.

Author Bio

William L. Silber is the Marcus Nadler Professor of Finance and Economics at the Stern School of Business, New York University. He is also a member of the New York Mercantile Exchange where he has traded options and futures contracts.

In the past he managed an investment portfolio for Odyssey Partners, and has also been a Senior Vice President, Trading Strategy, at Lehman Brothers, a Senior Economist with the President's Council of Economic Advisors, a member of the Economic Advisory Panel of the Federal Reserve Bank of New York, and a member of the investment committee of the SSRC endowment fund. He holds an M.A. (1965) and Ph.D. (1966) from Princeton University and is a graduate of Yeshiva College (1963).

He has consulted for various government agencies, including the Federal Reserve Board, the U.S. Senate Committee on the Budget, the House Committee on Banking and Financial Services, and the President's Commission on Financial Structure and Regulation. He has testified in Congress and has been an expert witness in a number of court cases. In 1980 he received the Excellence in Teaching Award at NYU's Stern School of Business and was voted Professor of the Year by MBA students in 1990, 1997, and 2018. In 1999 he was awarded NYU's Distinguished Teaching Medal.

His newest book, The Story of Silver: How the White Metal Shaped America and the Modern World, (Princeton University Press, 2019) chronicles silver's transformation from soft money during the nineteenth century to hard asset today, and tells how manipulations of the white metal by American president Franklin D. Roosevelt during the 1930s and by the richest man in the world, Texas oil baron Nelson Bunker Hunt, during the 1970s altered the course of history.

An earlier book, VOLCKER: The Triumph of Persistence, Bloomsbury (2012), a biography of former Federal Reserve Chairman Paul A. Volcker, was named the China Business News (CBN) 2013 Financial Book of the Year, was a finalist in the Goldman Sachs / Financial Times 2012 Business Book of the Year Award and has been the subject of in-depth reviews in the press.

In the past he has published over fifty articles in professional journals, has been an Associate Editor of the Journal of Finance and of the Review of Economics and Statistics and has published the following books and monographs: When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy, Princeton University Press (2007); Selected Essays in Finance (editor), Blackwell Publishers (2002); Principles of Money, Banking and Financial Markets (co-author), Addison Wesley (1974, 1977, 1980, 1983, 1986, 1989, 1991, 1994, 1997, 2000, 2004, 2009); Financial Options: From Theory to Practice (co-editor), Dow Jones-Irwin (1990); Money (co-author), Basic Books (1970, 1973, 1977, 1981, 1984); Municipal Revenue Bond Costs and Bank Underwriting, Monograph Series, New York University(1979); Commercial Bank Liability Management, Reserve City Bankers (1978); Financial Innovation (editor), D.C. Heath & Co. (1975); Portfolio Behavior of Financial Institutions, Holt, Rinehart & Winston (1970).

Source: NYU Stern School of Business

Videos

No Videos

Community reviews

Write a ReviewNo Community reviews